|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

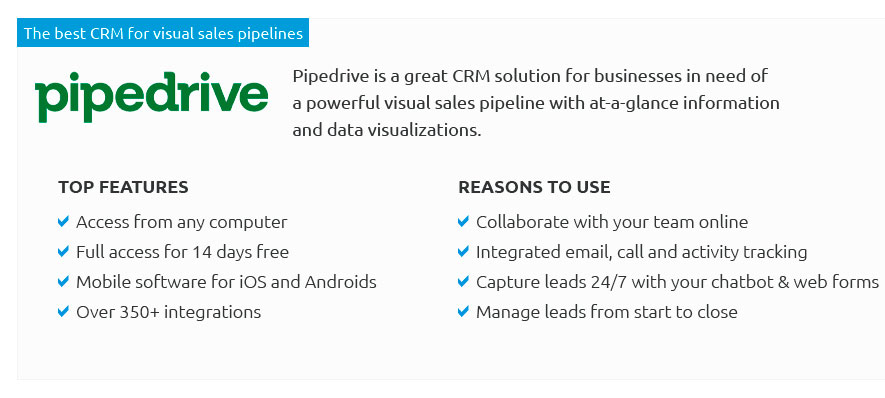

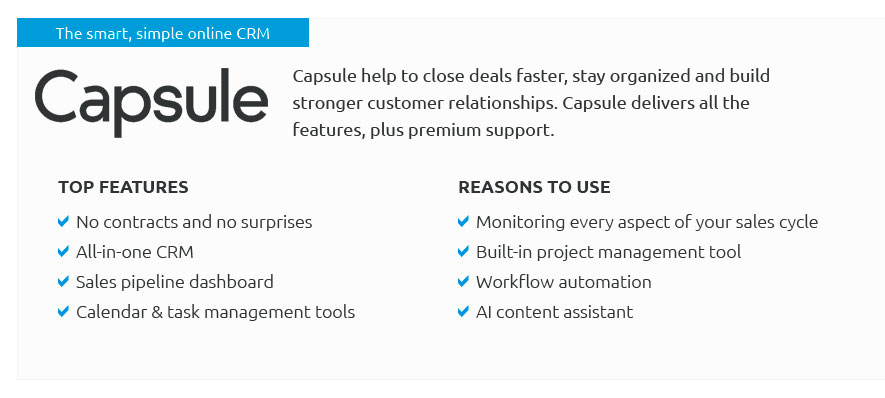

Understanding CRM for Financial Advisors: Important ConsiderationsIn the dynamic world of financial advising, the importance of CRM systems cannot be overstated. As financial advisors strive to enhance client relationships and streamline operations, Customer Relationship Management (CRM) tools emerge as indispensable allies. These systems are designed not only to manage client interactions but also to provide a comprehensive overview of client data, enabling advisors to tailor their services and foster long-term loyalty. However, choosing the right CRM system requires a nuanced understanding of its features and benefits. Firstly, the integration capabilities of a CRM are paramount. Financial advisors often utilize various platforms, from portfolio management software to communication tools. A CRM that integrates seamlessly with these systems can significantly enhance efficiency, reducing the need for manual data entry and minimizing errors. This integration fosters a unified ecosystem where all client data is readily accessible, empowering advisors to deliver personalized advice based on real-time information. Moreover, the customization options offered by CRM systems are crucial. Each financial advisory practice is unique, with specific processes and client needs. A CRM that allows for customization ensures that advisors can tailor the system to their workflows, maximizing productivity. Custom fields, reports, and dashboards provide a level of flexibility that can accommodate the evolving demands of a financial advisory firm.

In conclusion, while the selection of a CRM system involves careful consideration of numerous factors, the benefits it offers to financial advisors are substantial. From improved client relationships to streamlined operations, a well-chosen CRM can serve as a cornerstone of a successful financial advisory practice. As the industry continues to evolve, the adoption of sophisticated CRM tools will undoubtedly play a pivotal role in shaping the future of financial advising. https://www.maximizer.com/solutions/crm-for-financial-advisors/

What makes Maximizer the best CRM for financial advisors? Maximizer CRM is designed with financial advisors in mind, providing tailored tools to manage client ... https://bluroot.ca/top-5-crms-for-financial-advisors/

Maximizer is a generic CRM but can be customized to the needs of financial advisors. It offers client profiles that include family members and heirs, as well as ... https://www.sugarcrm.com/industries/financial-services/wealth-management/

Sugar is a complete customer relationship management platform that collects every bit of critical information across sales, service and marketing. It easily ...

|